How Hardik & Pooja Shah Tricked Investors? Details Of The Shah’s Investment Scam

Financial frauds have become more common and is rising equally with the rise of the country’s economy. One of the latest scams, involving Shah’s Investment, a Surat-based firm, has shaken the financial world, leaving people wondering how a couple can cause so much damage without being noticed.

According to reports, the mastermind behind the scam was Hardik Shah and Pooja Shah, a couple who lured people in with the promise of big profits and cheated those who fell for their trap.

The couple targeted investors by promising them high returns in short timeframes – 12% in over three months, 8% in two-and-a-half months, and 4% in just over a month. There was no real business, but a Ponzi scheme, which involved them paying the earlier investors with the money taken from new investors with no actual profit being made. It was a carefully planned scam through which Hardik and Pooja wanted to earn fast money.

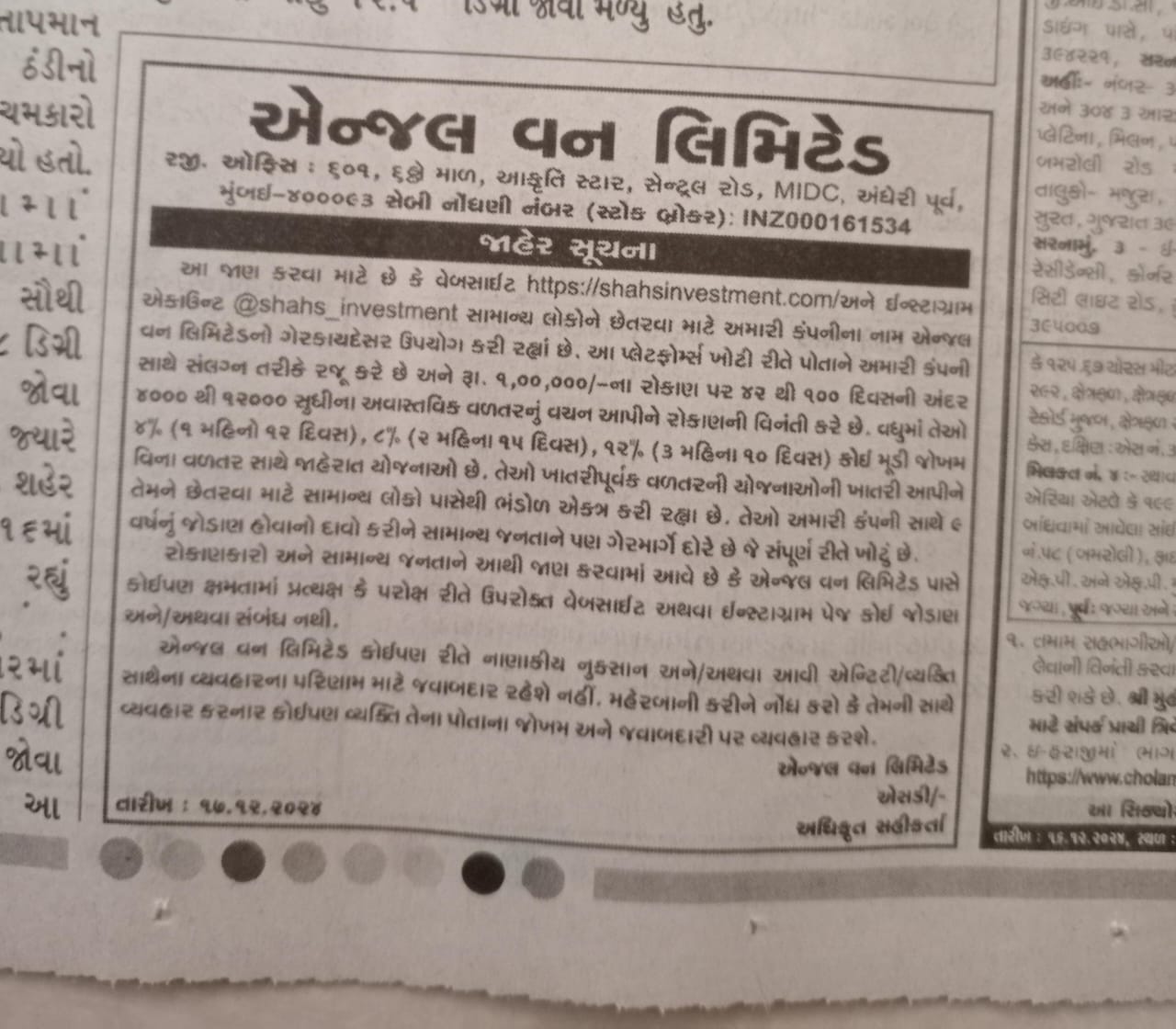

Angel One Breaks The Silence, Warns the Public

On 17th December 2024, one of India’s trusted stock brokers; Angel One issued an official warning, where they revealed everything about Shah’s Investment for people to know they are a fraud and how they used Angel One’s name to appear more trustworthy.

Angel One made it clear in the statement, that they have no ties with the fraudulent firm and also urged people to not associate themselves with them.

The purpose of the public statement was to inform people about fraudulent schemes that promise high returns in little time and to be alert if they come across similar things ever.

As a reputable stock brokerage firm, Angel One also highlighted how important transparency is in investments and that people shouldn’t fall for schemes that sound too good to be true because, in most cases, they are scams.

Using Social Media To Earn People’s Trust

Shah’s Investment used social media platforms to promote their scheme and make it appear more genuine with the help of influencers. They also had an official website (shahsinvestment.com) that looked like any other genuine website, so people would think they were a legitimate company.

On their Instagram handle (@shahs_investment), they painted a picture of success and reliability and even roped in influencers to promote their scheme. They also used paid ads on Facebook and Instagram to create a buzz and reach more people to fall their trap.

These marketing tactics worked well because many people believed it was real and wanted to put their money in what seemed like a booming investment firm without knowing the reality behind it.

Fake SEBI Claims

SEBI (Securities and Exchange Board of India) keeps the financial market in check by ensuring companies follow the law and don’t cheat investors. Shah’s Investment fooled investors by claiming to have a registration with SEBI when in reality they had none.

They made up a lie to win people’s trust and make them invest in the firm without questioning their legitimacy.

A firm having a SEBI registration guarantees safety and that’s the reason, why they pretended to have one, so people would trust in their scheme and believe they were in safe hands.

This is why, it is so important to double-check such claims, no matter which firm it is because you never know if they are lying just like Shah’s Investment did. If a company isn’t listed or registered with SEBI, it’s a clear warning sign and needs to be avoided at all costs.

Risky Trap Of Fast Money

Turning money into more money quickly and easily is possible if it’s done through legit means, otherwise it can cost you dearly. This is exactly what happened in Surat, where, Shah’s Investment left many people who trusted them with their money shocked and empty-handed.

Run by Hardik and Pooja Shah, the company promised attractive returns in a short time and also without risks. What seemed like a golden opportunity to earn a greater profit turned out to be a clever scam with people losing their money.

Like many Ponzi schemes, the business depended on fresh investments to pay old investors and the cycle looked fine until new money stopped flowing in without a real way of generating profit, the scheme started to fall apart, leaving many investors without their savings and with no real answers.

Once Shah’s Investment stopped paying out the returns it promised, investors faced repeated delays and started questioning the legitimacy of the firm.

The company promised new withdrawal dates, but failed every time and this continued long enough for people to have doubts and fear they lost their money.

Smart Steps To Avoid Getting Scammed

If you want to stay safe from shady investment schemes like Shah’s Investment, practice caution and follow these steps.

- Check The Legitimacy

Before investing your hard-earned money, make sure the firm you are getting involved with is legit and not a scam. Check with proper authorities like SEBI and doesn’t just trust what the firm says because they could be lying for all you know.

- Dig Deep Before You Invest

Learn about the company because as an investor you should have an idea of who runs it, how it works, and what others are saying. If you just go by what’s on their website or social media, you are deemed to get cheated if it turns out to be a scam.

- Be Wary Of High Returns

If a company promises sky-high profits in just a few months, it’s probably not real because good investments take time and involve risk as well. Do a thorough research and get involved only if you see a green signal.

- Ask the Experts

If you are not sure about an investment, talk to a financial advisor who knows the market well because their insights can save you from big losses.

Final Thoughts

The Shah’s Investment case is a reminder of how all opportunities are not genuine, but a nightmare to shake up your world. No matter how tempting an investment scheme appears, verify the details before getting involved, otherwise you may end up like one of those investors in the Shah’s Investment case in Surat.